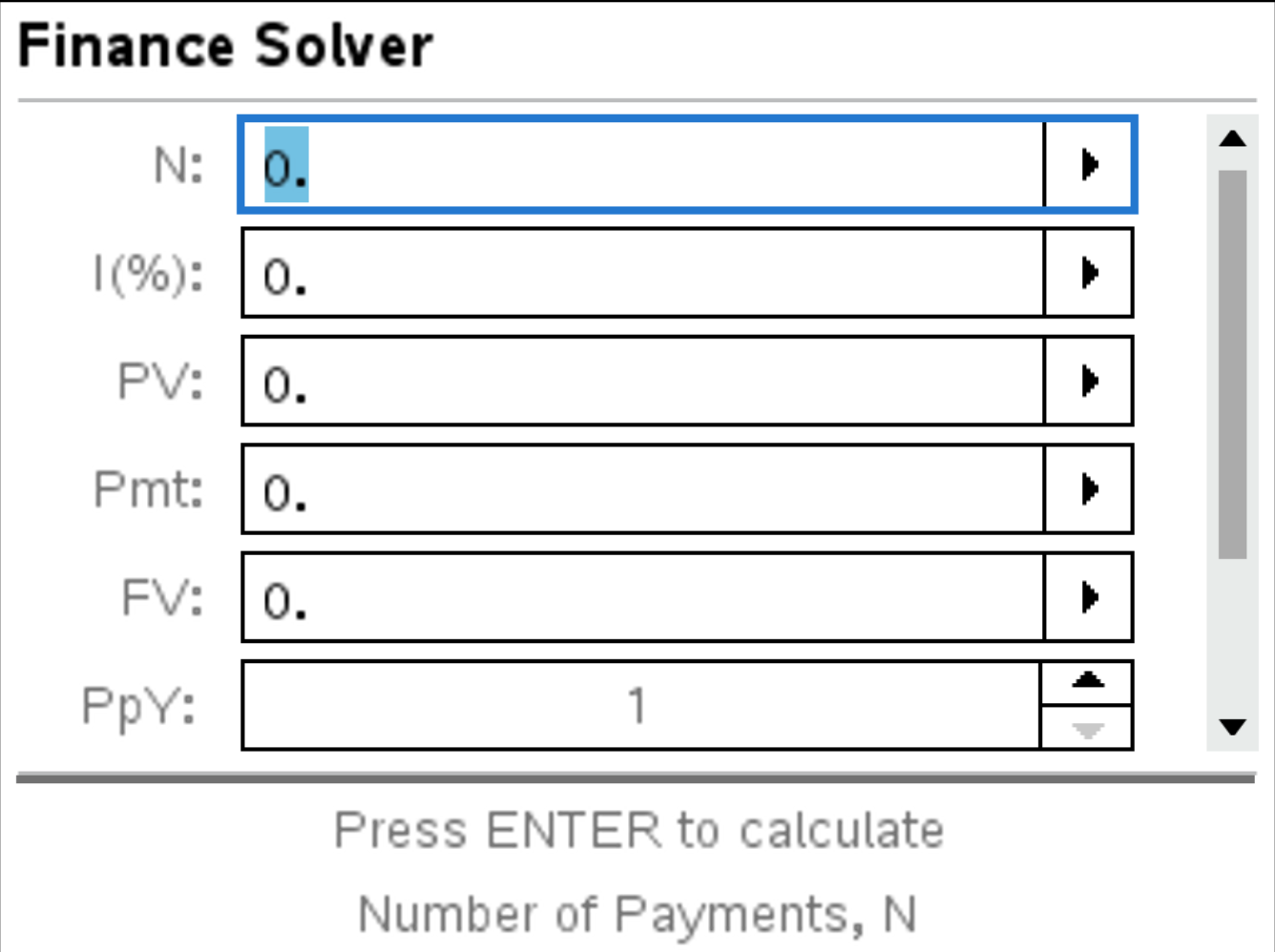

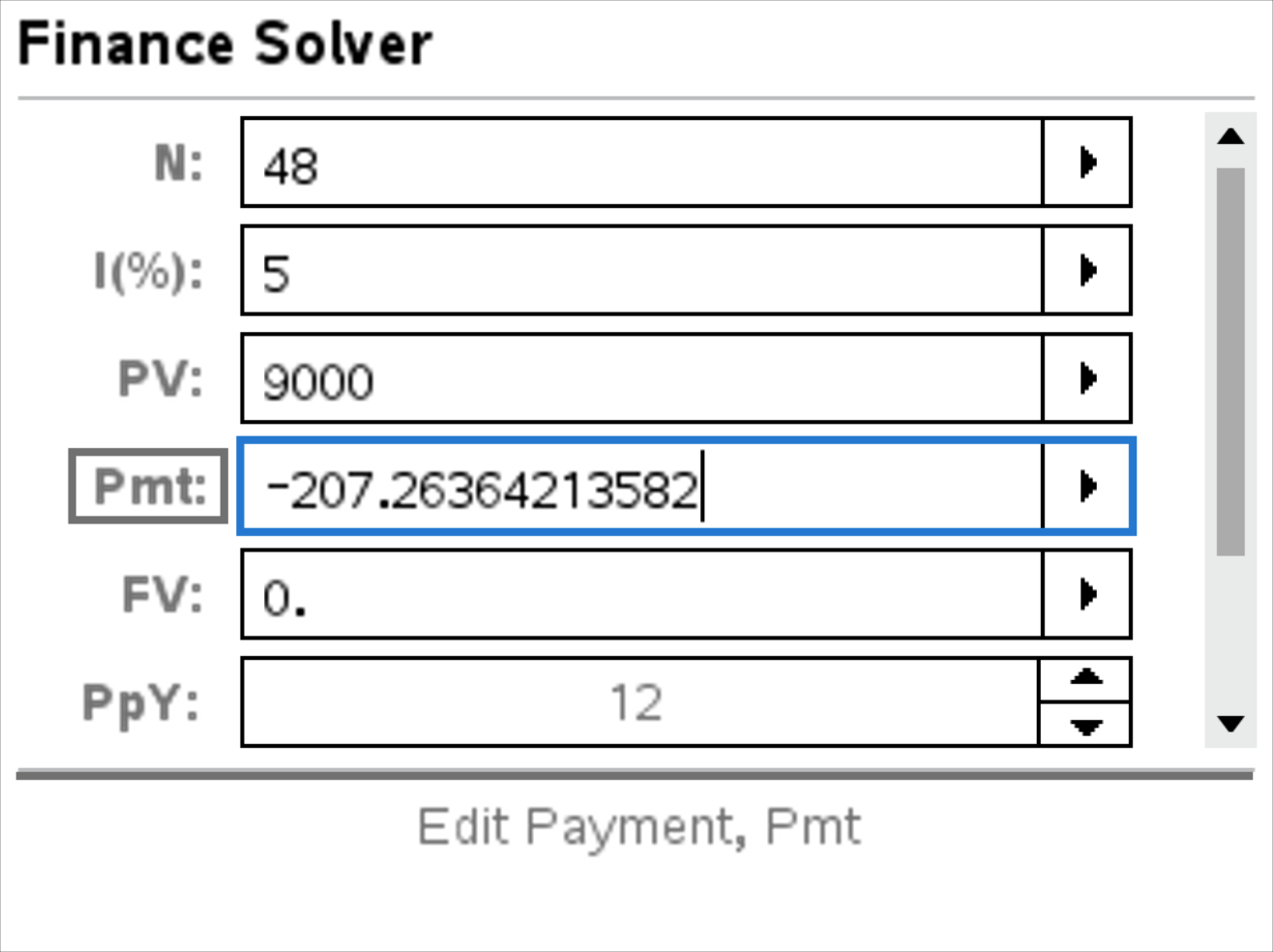

The very useful Finance Solver can be used for various compound interest problems. Below is an explanation of the fields:

, select Finance > Finance Solver.

, select Finance > Finance Solver.

Enter cash inflows as positive numbers and cash outflows as negative numbers.

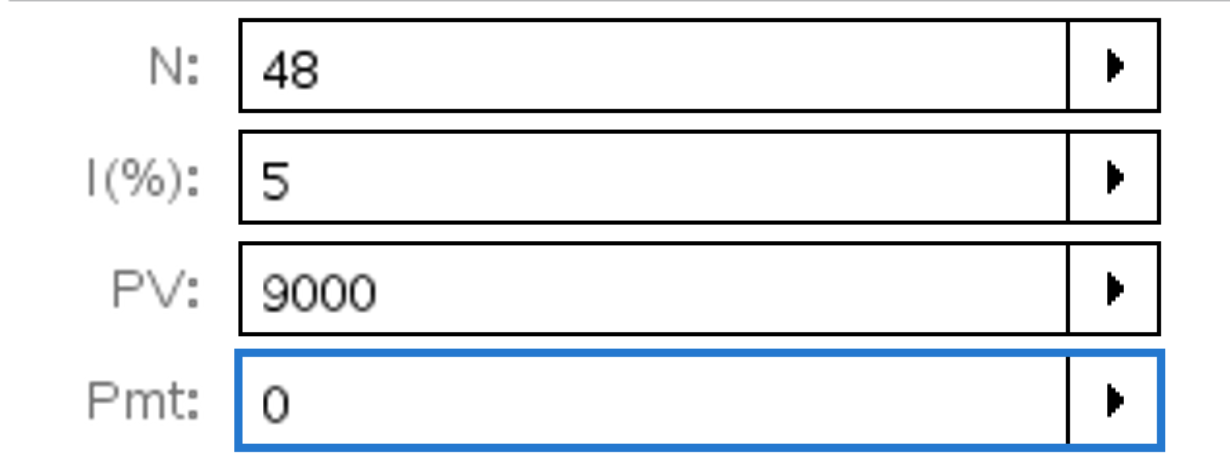

Suppose you want to buy a car that costs $9,000. You can afford payments of $250 at the end of each month for four years. The bank offers an interest rate of 5%, compounded monthly. Can you afford it?

, select Finance > Finance Solver, and fill the app as follows:

, select Finance > Finance Solver, and fill the app as follows:

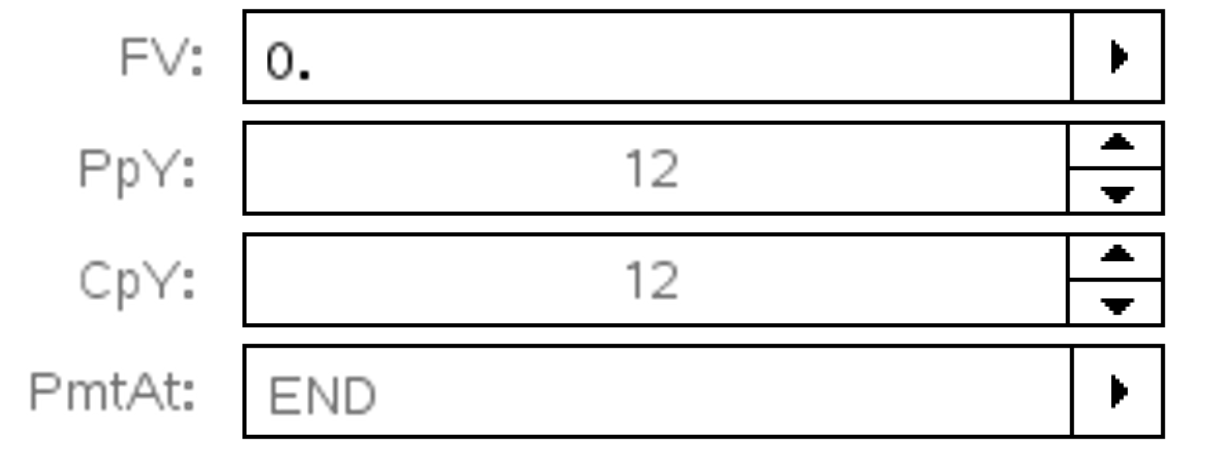

.

The following result will be displayed:

.

The following result will be displayed:

The  rectangle indicates the value solved. Thus, you can afford the car since you would have to pay about $207.25 (displayed

as a negative number since it’s an outflow of cash) per month, which is less than $250.

rectangle indicates the value solved. Thus, you can afford the car since you would have to pay about $207.25 (displayed

as a negative number since it’s an outflow of cash) per month, which is less than $250.

Ensure the interest rate and compounding periods match for accurate results.